"The FTX debacle came at the end of an annus horriblis that had already seen a tech sector collapse, sharply higher interest rates and self-inflicted industry wounds," said Ben Laidler, global markets strategist at eToro.

Cryptocurrency crash: Reuters talks about FTX crash.

FTX crash impact on BTC:

The cryptocurrency world is in a tough situation after a big cryptocurrency exchange called FTX and other important players had big problems last year. The prices of cryptocurrencies, the amount of trading, and the money put into them by investors are all much lower than they were in 2021.

In a noteworthy development, Sam Bankman-Fried, the erstwhile Chief Executive Officer of FTX, finds himself at the center of a trial unfolding in New York. The charges brought against him are of a serious nature, encompassing seven counts related to fraud and conspiracy. These allegations are directly linked to the sudden and unexpected downfall of the exchange, a prominent event that transpired in November 2022. Worth noting is Mr. Bankman-Fried's steadfast assertion of innocence, as he has formally entered a plea of not guilty in response to these legal proceedings.

Read more:

Crypto crash: Why BTC fall down $2000 with in few days?

Bitcoin, the biggest cryptocurrency, has gone up about 37% since November 1st. It was doing really well in 2021, reaching a record high of $69,000 in November. But when central banks started making interest rates higher in early 2022, cryptocurrencies like bitcoin, which are seen as risky, started having problems. People wanted to invest their money in other things that gave them more profit.

Bitcoin lost more than 65% of its value last year because of this, and also because of the problems with a cryptocurrency called terra USD. That caused a big hedge fund in Singapore to go bankrupt and made the cryptocurrency world very unstable. Other companies also had problems, but when FTX had its issues, bitcoin's price dropped to under $16,000 in November.

Bitcoin had more problems this year when a popular bank in the U.S. that works with cryptocurrency companies said it was going to close down.

But bitcoin has gone up almost three-quarters of its value this year because big financial companies like BlackRock are interested in it, and it seems like the problems with interest rates are getting better. Right now, it's trading at about $28,089.

FTX crash impact on market capital and trading volume:

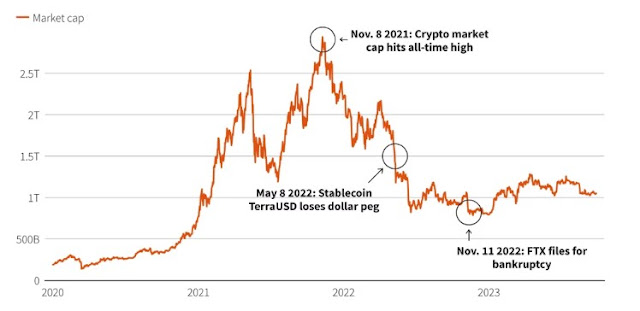

In November 2021, the global cryptocurrency market reached its zenith, boasting

a staggering valuation of $3 trillion. However, as the year 2022 unfolded, it

witnessed a dramatic decline, plunging to a two-year nadir of $796 billion,

primarily attributed to the tumultuous events surrounding FTX. In the wake of

these tumults, the market managed to regain some of its lost ground,

maintaining a position above the $1 trillion threshold for the majority of this

year.

The reverberations of the FTX debacle cast a shadow of doubt and uncertainty over the broader cryptocurrency ecosystem. Usman Ahmad, the CEO of Zodia Markets, the cryptocurrency exchange affiliated with the global banking behemoth Standard Chartered (STAN.L), expressed his reservations, acknowledging that the issues with FTX had undoubtedly eroded confidence in the crypto sphere.

The aftermath of the FTX meltdown witnessed a dramatic and consequential drop in crypto trading volumes. Traders, initially attracted by the market's robust liquidity, were forced to hit the pause button on their buying and selling activities or, in some cases, exit the market entirely.

Fast forward to September 2023, and a somber picture emerges. Total monthly trading volumes across both spot and derivative markets plummeted to a mere $1.4 trillion, representing a stark nosedive of over 60% compared to September 2022. Within this grim landscape, spot markets bore the brunt of the downturn, experiencing a colossal decline of more than 70%, with volumes dwindling to a mere $272 billion.

Derivative volumes, while not immune to the turmoil, managed to retain a relatively higher but still substantial decline, with a 60% reduction to $1.1 trillion over the course of the 12 months since September 2022. A significant contributing factor to this decline was the exodus of major market makers from the scene following the FTX debacle. Their departure had a profound impact, drastically reducing liquidity levels, consequently resulting in both meager trading volumes and diminished market volatility. This confluence of factors was aptly summarized by Noelle Acheson, an economist with a keen focus on the cryptocurrency sphere.

0 Comments